Show Notes

We’ve all heard the term, “beauty is in the eye of the beholder.” When it comes to the stock market, I’d simply change “beauty” to “risk” in this expression. How you define risk plays a huge role in your perception of stock market investing. A look at one set of data points may change all of that.

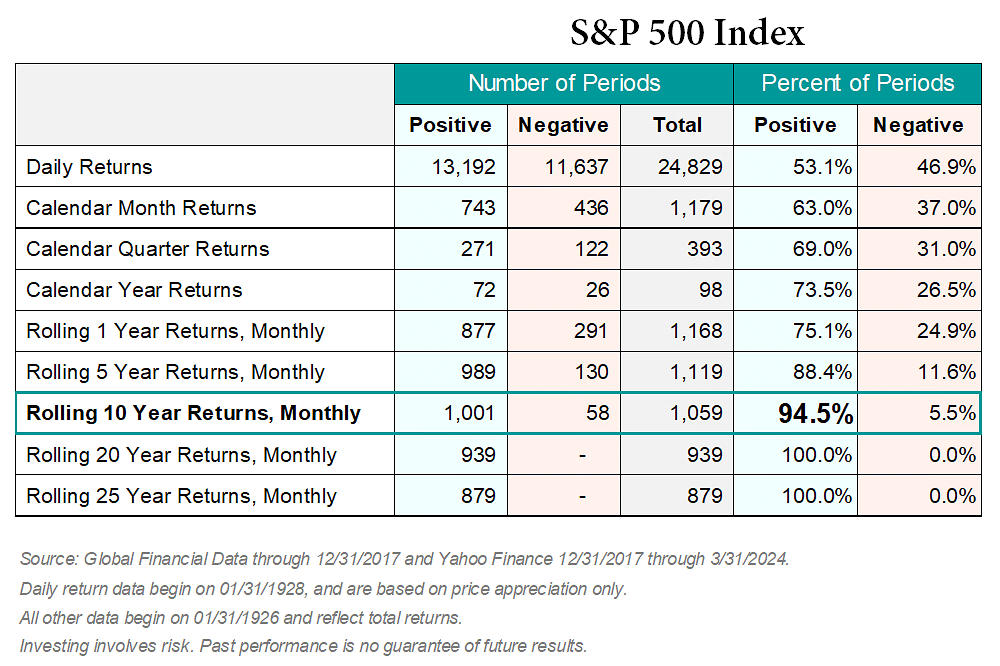

Jeff Harrell breaks down the fascinating results of a research report that analyzed stock market returns over various time periods, leading to a discussion about how risky the stock market is…or is not.

Investing involves risk, including the loss of principal—as all investment firm marketing pieces must disclose—but you should also understand that when it comes to financial markets, risk and volatility don’t mean exactly the same thing.

After hearing this episode, think about whether or not you agree with Jeff that one of the riskiest financial things you can do in your lifetime is to NOT invest in the stock market.

(Season 1 Episode 4)

Resource Mentioned in Episode:

Data illustration showing positive versus negative stock market returns over various time periods:

Other Episode Referenced:

Podcast produced by Ted Cragg of QuickEditPodcasts.com

Music Credit: Dream Cave / Adventure Awaits / courtesy of www.epidemicsound.com

Transcript

I’m afraid to invest in the stock market because it’s just too risky. Oh boy…this is definitely one of the most common things I hear from individuals when they start learning about investing. They’ve heard stories of how much money people have lost on bad investments, or maybe they remember the news headlines during the most recent bear market where it seemed like everything was crashing. They might even have a devastating personal story of a friend or family member who got hurt really bad investing in the stock market.

So, while I certainly want to acknowledge that investing does involve risk, I truly believe that one of the riskiest things you can do in your lifetime is to NOT invest in the stock market.

Welcome to the first season of Invested Poorly: Sad Tales of FInancial Fails, a short-form podcast designed to help everyday investors make wiser investment decisions by learning what NOT to do with their money. Host Jeff Harrell shares timeless stories from his former life as a financial advisor, about the poor—and irrational—choices he witnessed investors make that disrupted their journey to financial independence, or FI. Your ability to recognize, and avoid, similar mistakes could make all the difference for you along your path to reach FI.

Check out the “Introduction” episode for more background on Jeff, why he created this podcast, and how it can guide you to becoming the hero of your own investing story. Now, on with show.

In episode 3, I discussed the difference between saving and investing. If you haven’t listened to that episode yet, I’d encourage you to do so. This episode can stand on its own, but listening to episode 3 first helps frame what we are about to discuss, which is the definition of risk.

Unfortunately, many investors look at risk as how volatile something might be in the short-term because the potential returns are so variable. While this is absolutely true and should not be dismissed, investors should be looking at their investments as something that will serve them well for many years, or even decades in the future. The ability to ignore short-term volatility, in favor of long-term probability is one of, if not the, most important attributes of a wise investor…and I have the data to prove it.

But before we jump to that, let’s get this out of the way. Investing involves risk, including the loss of principal. Yep, this is one of those boilerplate disclosures on every investment-related piece of marketing collateral you will ever see, including in my own podcast disclosure! It’s like a compliance officer’s worst nightmare to send out a marketing piece without this phrase slapped all over it. Obviously, this is done for a reason, and that’s because at the end of the day, no one has a crystal ball.

And even I will admit, anything, and I do mean anything, could happen. Aliens could invade the Earth, the sun could explode, the zombie apocalypse could start tomorrow, and of course the stock market could drop 80-90%, or even worse go to 0. Although none of these are very likely, I will admit all of these could happen.

But if you take a deep breath and think about it, they probably all have the same likelihood of occurring, which is pretty close to zero. Not to mention, if any of these actually did happen, the least of your concerns is going to be your stock market investments, so from my standpoint, I don’t think it’s worth wasting even one brain cell thinking about it.

So with that caveat out of the way, let’s take a more rational approach to assessing risk by using the past as a guide. I came across a research report early in my career which illustrated the positive, versus negative, returns of the stock market over various time periods. I now like to update the data annually, which you can view for yourself by checking out this episode’s description. The results are fascinating when discussing how risky the stock market is.

I’ll give you some highlights of the data. First, it probably isn’t a great surprise that on a day-to-day basis, the likelihood the stock market will be up versus down is barely over 50%. However, as soon as you start lengthening your timeframe, the results change pretty quickly. Simply adjusting your timeframe to monthly increases your odds of making money to over 60%. When you get to 12 months, you are approaching 75%. By the time you get to 10 years, we are talking about a 95% probability of making money. I don’t know about you, but anything that has a 95% chance of happening, doesn’t sound that risky to me.

Now, I always like to point out that I acknowledge I was a financial professional for over two decades and the majority of you listening don’t have the same level of investing expertise or experience that I have. I totally get it; that’s a fair point. But what I hope I can validate for you, is that the numbers we’re talking about are real because I have lived them. I walked away from a very lucrative career in financial services and I’m now putting my money where my mouth is.

I have my investments completely on autopilot because I have so much confidence in the financial markets over the long-term. I cannot begin to tell you how much I love NOT following investment news on a regular basis like I did when I worked in the industry. Back then I had to stay on top of everything because clients always wanted to get my take on what was going on; thus, I had to follow the financial market-related news.

Now, I don’t listen to any of it; I don’t read economic reports; nor do I care about a single company’s earnings. I simply invest in the stock market and let the power of compound interest and time be my friend. Albert Einstein once referred to compound interest as the eighth wonder of the world. If you weren’t already aware of this, take my inquisitive little nephew’s advice and “search it up.” You will be blown away by what you find on the power of compound interest.

When you combine the data points I discussed earlier, which again, are available within the episode description, with the articles you can find all over the internet on compound interest, I’m hoping you will be left with the same level of confidence I have in the financial markets.

I sure hope you enjoyed this episode of Invested Poorly and will be able to take something from it to improve your decision making as you navigate the twists and turns of your personal investing adventure. Be sure to check out my website at AreYouFI.com (that’s A R E Y O U F I dot com) where you can find resources and show notes with the charts and graphs I mention during the episodes. These are like little treasure maps that can help you choose more wisely along your quest to reach FI, or financial independence.

Never forget, in the short-term the stock market is unpredictable, and as my mischievous little nephew likes to say, “things just happen”! So focus on the long-term, by controlling your emotions, simplify your investments, and always… ignore the noise.

I’m your host, Jeff Harrell. Thanks for listening.

Invested Poorly: Sad Tales of FInancial Fails was created for informational purposes only and should not be relied on for specific tax, legal, or investment advice. You should consider consulting a qualified professional to review your situation before engaging in any transactions. Investing involves risk, including loss of principal and past performance is no guarantee of future results.

This podcast was produced by Ted Cragg. Learn more about creating podcast mini-series like this by visiting QuickEditPodcasts.com.